bpha today (6 August 2020) released its financial statements for the year ended 31 March 2020, reporting a continuation of its strong financial performance.

Highlights

- £60m operating surplus

- Completion of 651 new affordable homes

- A+ (negative) Credit Rating and V1/G1 viability and governance ratings maintained

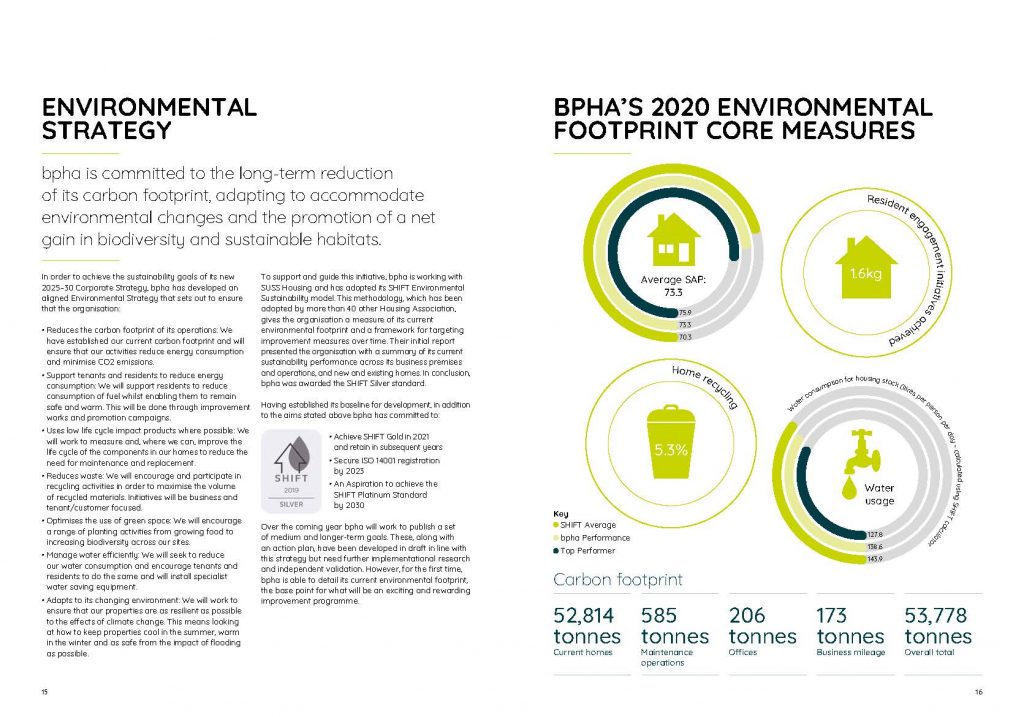

- Development of a new Environmental Strategy

- Debut Private Placement raised £125m of mostly unsecured new debt at sub 2.5%.

Investment for growth

bpha invested £106m in existing and new homes in the year ended 31 March 2020, delivering 651 new affordable homes. As bpha grows, investment continues in technology and people to ensure it has a modern, scalable and efficient operational structure.

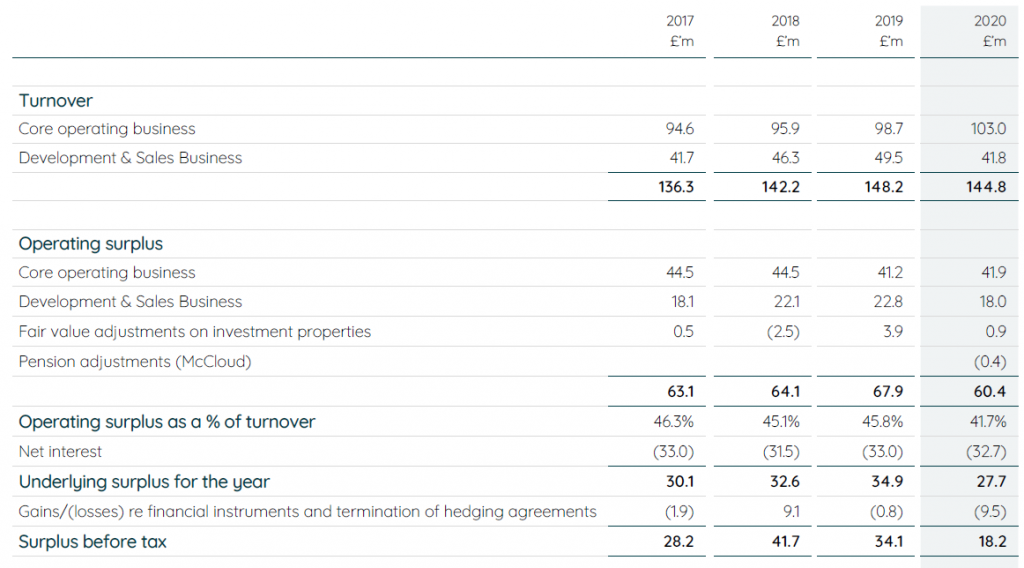

Operating business performing well

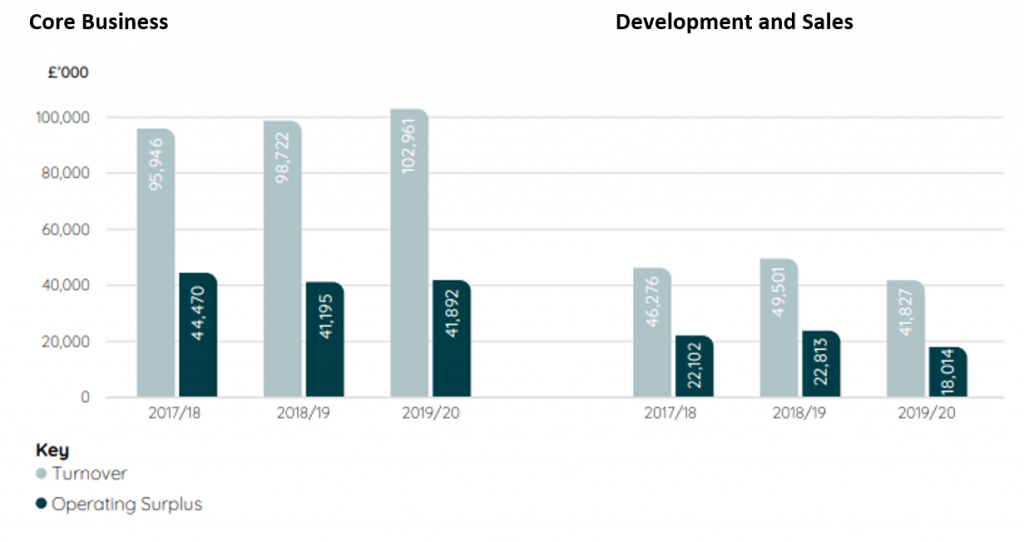

The report shows that core operating business continues to perform strongly with a margin of 41% (2019: 42%) from an increased turnover of £103m.

The Development and Sales business also performed well with sales of £42m (2019: £50m) in a year characterised by underlying economic uncertainty and the initial impact of the COVID-19 pandemic.

The number of first tranche shared ownership units sold of 173 (2019: 190) producing £10m surplus, was a positive performance in a difficult market alongside profits on disposal of fixed assets (primarily shared ownership staircasing) producing £8m.

Strong cash generation and liquidity levels

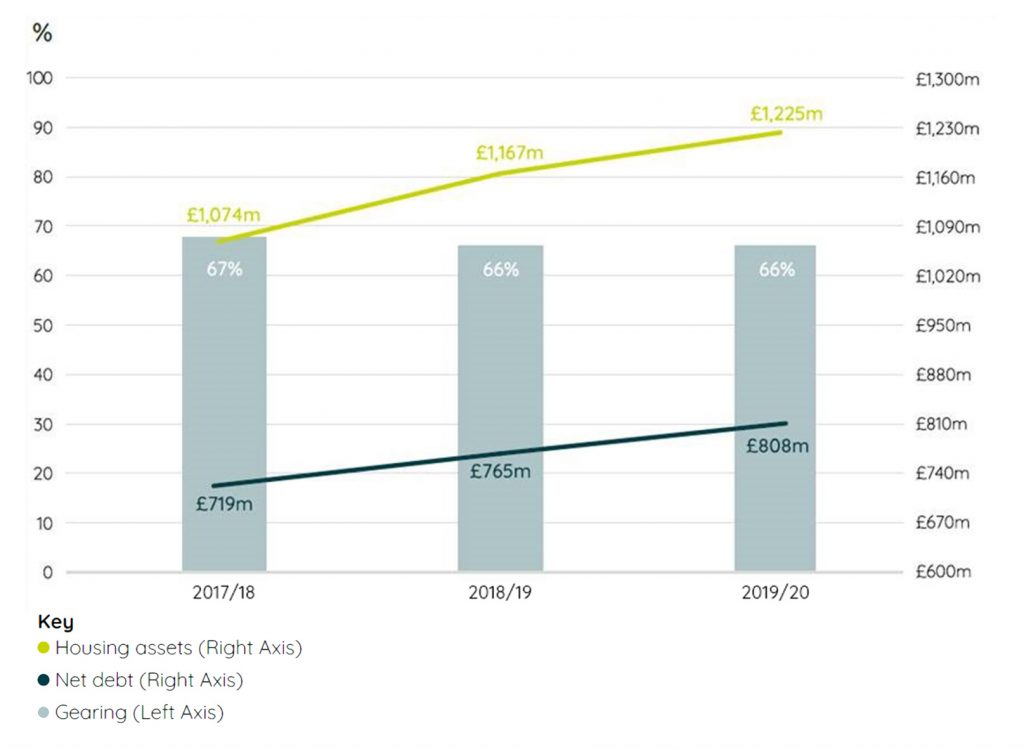

Strong and steady cash flows from operations have contributed towards more than half of bpha’s development spend, with net debt only rising by £43m to £808m. The core rental business is not dependent on its Development and Sales Business and so is less affected by open market factors such as Brexit uncertainty and the impact of the COVID-19 pandemic.

Investors’ confidence in bpha and its management team led to the successful issuance of a debut private placement during the year and has ensured high liquidity levels are maintained. bpha increased its liquidity to £298m, which more than adequately covers its future development program.

bpha received the first instalment of its Private Placement (£76m) in March and the remainder (£49m) was received in May 2020, following the successful issuance in February 2020. The value of bpha’s housing assets has continued to rise, increasing by £57m during the year, enabling its gearing to be maintained at 66%.

A word from Julian Pearce, bpha’s Chief Financial Officer

“bpha remains in a strong financial position with excellent margins and high levels of liquidity after a challenging year.

Our continued strong financial performance means we can continue to provide an excellent service to our customers at a time when the wider economic environment remains affected by the impact of the COVID-19 pandemic and Brexit uncertainty.”