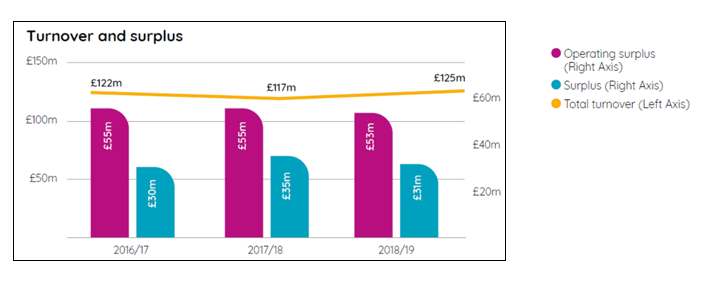

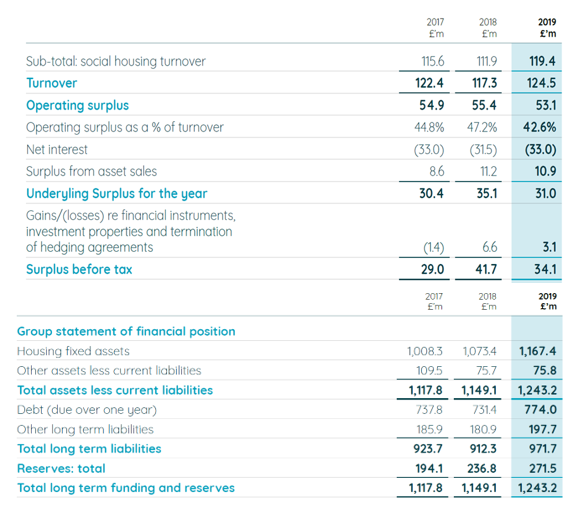

bpha today (16 September 2019) released its financial statements for the year ended 31 March 2019, maintaining strong operating margin of 42.6% (2018: 47.2%), with social housing lettings operating margin of 40.6% (2018: 44.3%).

This was achieved along with historically high investment rates in existing and new homes, including the completion of 621 new affordable homes.

Our highlights of 2018/19 included:

- £34m pre-tax surplus

- Strong balance sheet strength and improved gearing

- A+ (negative) Credit Rating and V1/G1 viability and governance ratings maintained

- 37% reduction in customer complaints and new engagement channels

- £165m of new debt raised

Investment for growth

bpha invested £134m in existing and new homes in the year ended 31March 2019, delivering 621 new affordable homes. It continues to invest in technology and people to help enhance the customer experience, drive quality and support future efficiency gains.

Strong cash generation

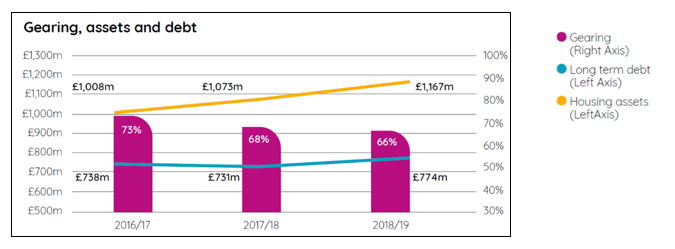

Strong operational cash flow resulted in long-term debt only increasing by £43m to £774m despite the investment in development of new homes. bpha’s core operations are cash generative with net cash flow from operating activities sufficiently covering both debt interest and capital expenditure on existing assets.

Housing assets increased by £94m during the year which combined with strong operational cash flow generation has led to an ongoing improvement in our gearing metrics. The strong performance continued with turnover of £125m, operating margin of 42.6% and pre-tax surplus of £34m (see appendix tables for more information).

“bpha’s financial performance in 2018/19 has remained strong, despite a number of challenges in the housing market and in the sector generally.

Our social housing operating margin remains securely above 40%, we have raised new finance competitively to support the extension of our development programme and have made strong and durable investments in our operational infrastructure.

All of this was achieved alongside the completion of 621 new homes, which has put bpha in the top 25 developers in the UK.

Our strong financial performance ultimately ensures we can continue to help provide an excellent service to our customers, who remain our central focus now and into the future.”

Kevin Bolt, bpha’s Chief Executive Officer

The bpha group 2019 Financial Statements are available at financialstatements.bpha.org.uk