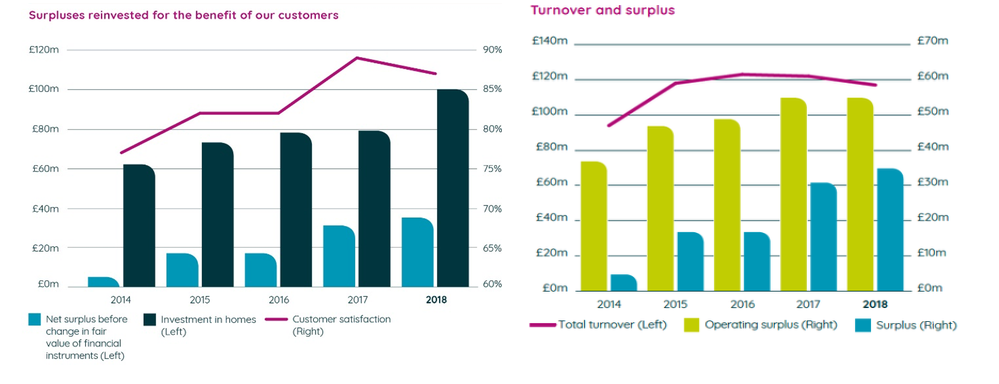

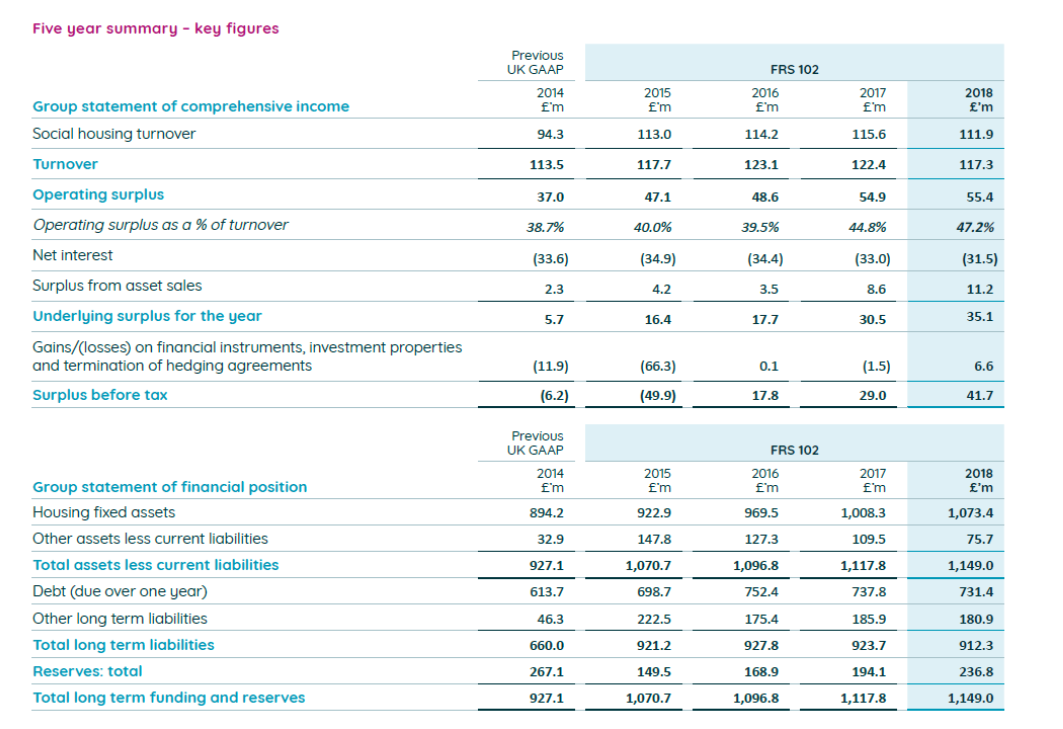

bpha today (2 September) released its financial statements for the year ended 31 March 2018 reporting continued strengthening in financial performance, delivering a pre-tax surplus of £41.7m (2017: £29.0m). Strong cash generation supported investment of £100m into homes in 2017/18, as well as continued investments in people, processes and systems to deliver better customer service.

Other highlights of the 2017/18 year included:

- Operating margin of 47.2% achieved overall and 44.3% on social housing lettings only

- A+ (stable) Credit Rating and V1/G1 viability and governance ratings maintained

- Overall 87% customer satisfaction with general needs service

Some of the key step changes that underpin this growth over the past 5 years are detailed below; during this time bpha have:

- Strengthened its finances with improved operating efficiency supported by significant improvements in treasury operations reducing weighted average cost of capital

- Developed a strong business model tightly focused on the Oxford to Cambridge corridor

- Grown through carefully controlled development of new housing

- Improved customer service through investment in homes, staff, management and governance, IT systems and new operational structures

The charts and tables which follow focus upon the underlying surplus for the year of £35.1m

(2017: £30.5m)

Operating surplus continued to perform strongly at £55.4m (2017: £54.9m) and the margin increased to 47.2% (2017: 44.8%) as operating efficiencies offset the impact of rent cuts. The operating surplus includes strong contributions from first tranche shared ownership sales, reflecting the quality of bpha’s social housing development pipeline. Interest is serviced entirely from social housing lettings and does not depend upon first tranche shared ownership sales or asset sales.

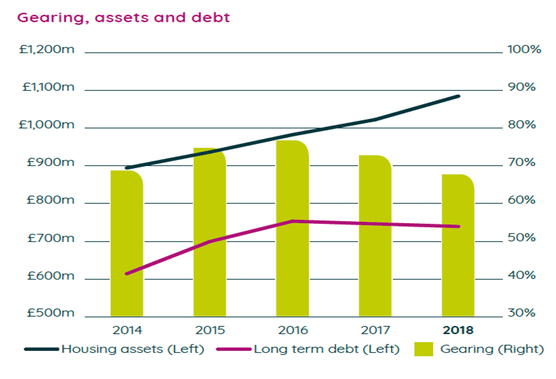

The value of bpha’s housing assets has continued to rise, and strong cash flow generation meant debt has fallen in the year leading to improvements in gearing metrics.

Paul Gray, Chief Financial Officer, said:

“In 2017/18 we continued to deliver strong financial performance. bpha operates in a region with a high demand for affordable homes and our focus is on our core social housing business. This, together with a carefully controlled development programme, has resulted in improvements in our finances over the five-year period from 2014 to 2018 generating higher surpluses, without reliance on asset sales or non-social housing activities. Our business model focuses upon a tightly defined core operational area across the Oxford to Cambridge corridor, which enables us to maintain close cost control, operate efficiently and thereby deliver value for money.

“Our net cash flow from operating activities is sufficient to cover both debt interest and capital expenditure on existing assets. During the year the net cash generated from operating activities combined with the proceeds from sales covered the majority of expenditure on development.

“Our strong finances and geographic focus mean that we are uniquely positioned to maximise the opportunity within the Oxford to Cambridge corridor. We have a successful track record of delivering new communities and experience of strategic partnerships with universities, hospitals, businesses and other housing associations. For many years we have applied strict controls over development commitments and consequently, our development pipeline means that on completion, new shared ownership and affordable rented homes add to our surpluses and to balance sheet strength.”

The bpha group 2018 Financial Statements are available here