Today (30 November 2020) we release our half year financial report results for the six months ended 30 September 2020.

Highlights

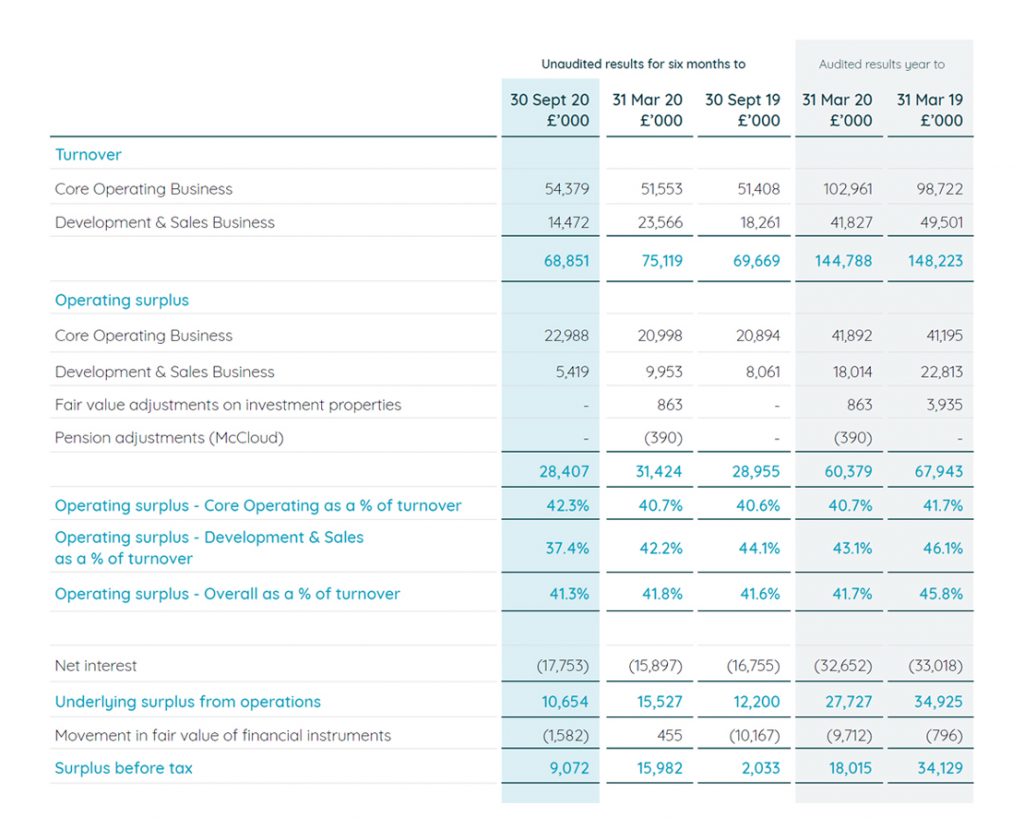

- Core Operating Margin of 42.3% (Sept 2019: 40.6%)

- Net cashflow from operating service increases to £30.2m (Sept 2019: £28.6m)

- 153 homes built since the beginning of the financial year

- £10.1m investment in existing assets

- Long-term credit rating of A+ was reaffirmed

Continuing growth and investment through challenging times

The report shows that bpha is continuing to maintain a strong financial performance, with a core operating margin of 42.3% (Sept 2019: 40.6%), and net cashflow from operating activities increased to £30.2m (Sept 2019: £28.6m).

Despite the impact of the COVID-19 pandemic, we’ve continued our investment in new affordable homes, having built 153 since the beginning of the financial year, in addition to investing £10.1m in existing assets.

Although the operating surplus from our development and sales business reduced to £5.4m (Sept 2019: £8.1m), this was a credible result in unprecedented circumstances, and demonstrates the underlying demand for homes in the Oxford to Cambridge Arc.

A word from Julian Pearce, bpha’s Chief Financial Officer

“We are very pleased that bpha has continued to deliver a strong financial performance in the first half year for 2020/21, despite the unprecedented economic challenges brought by the coronavirus pandemic since March.

“Our social housing operating margin remains strong reflecting our robust financial management and governance, and last month our long-term credit rating of A+ was reaffirmed, supporting our excellent liquidity position as we continue to be a safe and secure company in the current economic difficulties.”