Securing Our Future

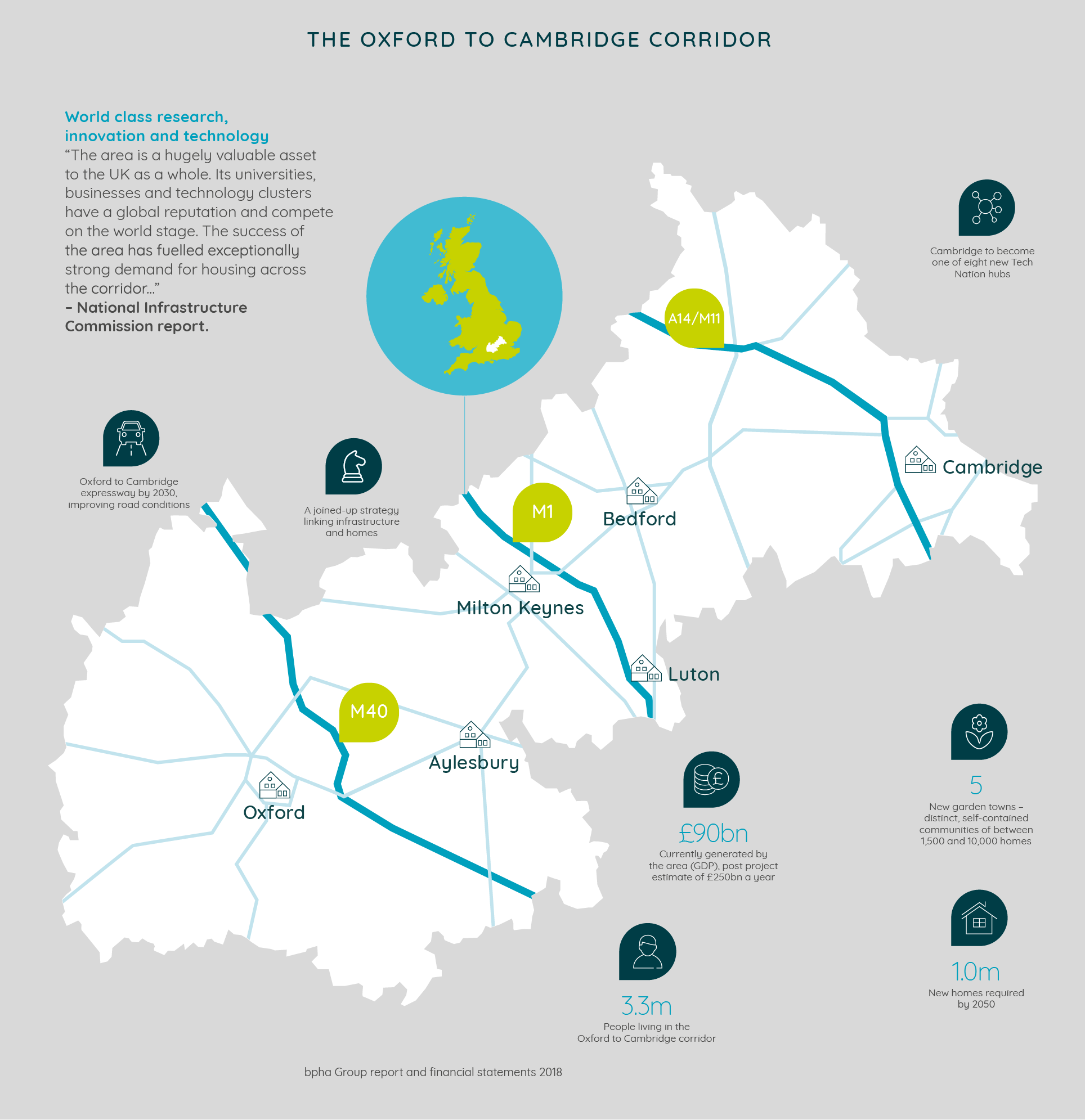

bpha is uniquely positioned to maximise the opportunity within the Oxford to Cambridge corridor.

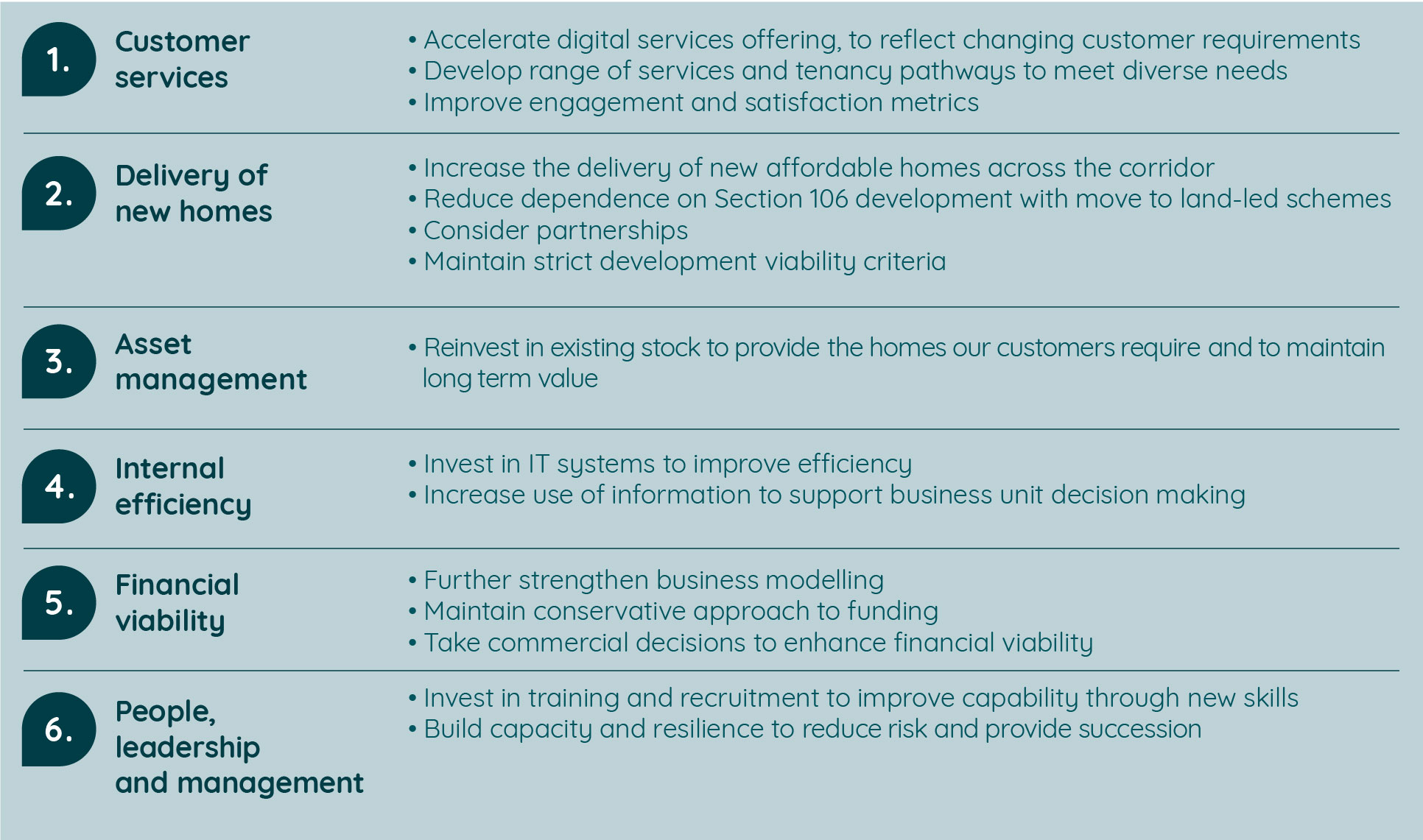

Six key strategic themes – our choices for our future

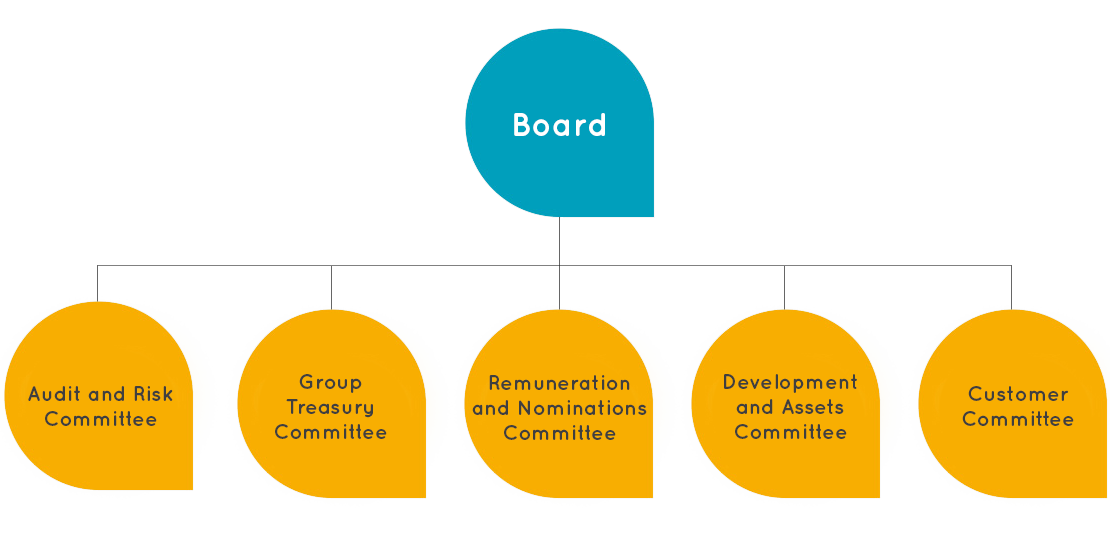

Board and Committee

Board

Non-executive directors

Professor Paul Leinster CBE

Chair of the Board

Ian Ailles

Chair of the

Audit and Risk

Committee

Paul High

Chair of the

Development and Assets

Committee

Katherine Horrell

Chair of the

Group Treasury

Committee

Dr Geraldine O'Sullivan

Non-Executive Director

Shirley Pointer

Chair of the

Remuneration and Nominations

Committee

Bob Tattar

Non-Executive Director

Executive Leadership Team

Kevin Bolt

Julian Pearce

Jeff Astle

Director of Development and Sales

Anna Humphries

Director of

Customers and

Services

Adrian Moore

Director of

IT

Paul Cook

Interim Director of Property Services

Gosia Motler

Director of Strategy & Corporate Finance

Lindsay Todd

Director of HR & Employee Engagement

Philippa Spratley

Director of Governance and Compliance

Eddie Kelly

Director of Governance and Compliance

Independent and other committee members

Viability Rating V1 / Governance Rating G1

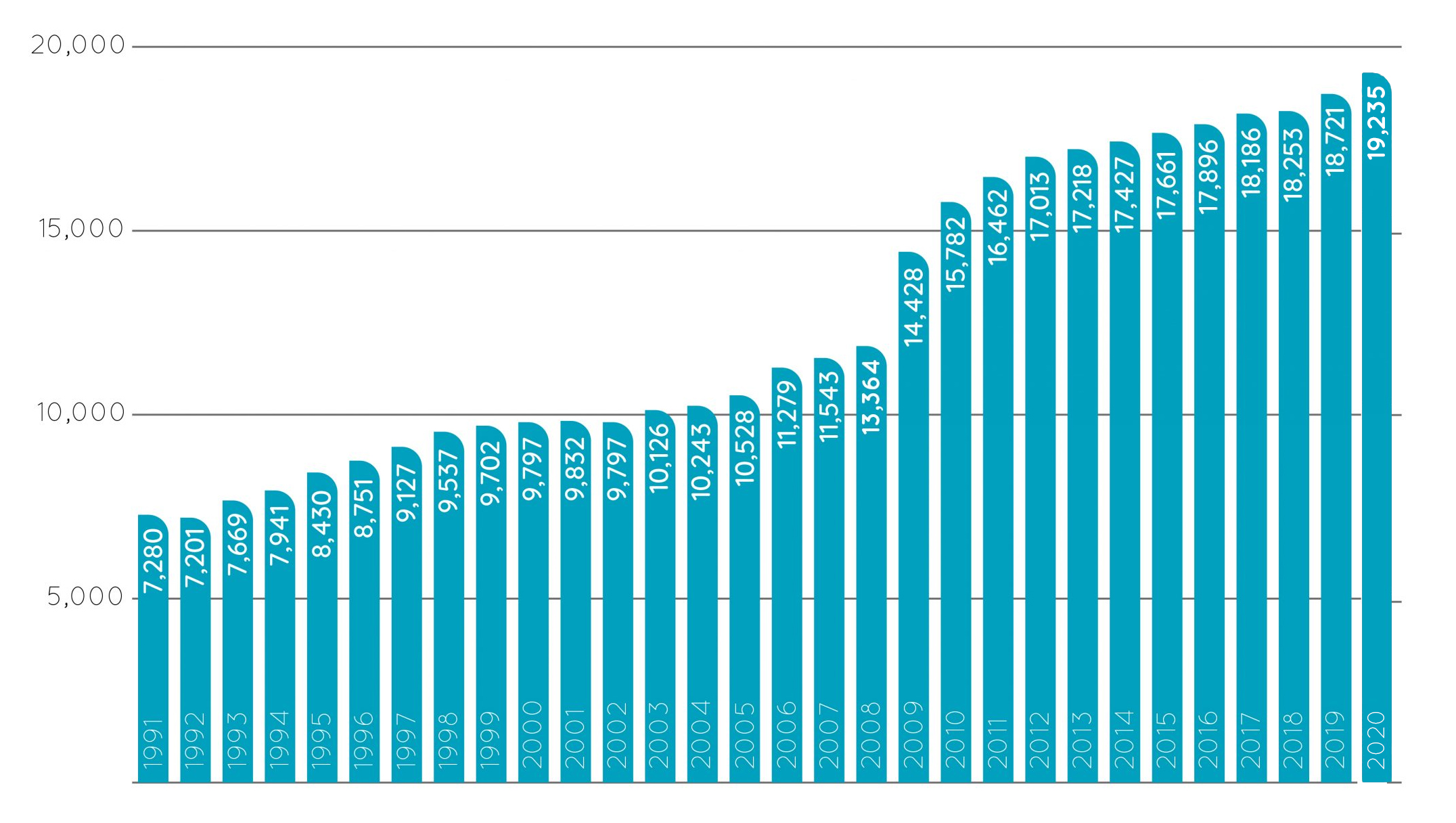

bpha has had a continuous growth strategy since its incorporation in 1990. Our current strategy is to produce 600 Affordable Homes per annum.

Homes owned or managed at year end

Development criteria

Strict development criteria is applied to all new projects to ensure each development enhances bpha’s financial strength.

- 35 year NPV and no terminal value

- Conservative development assumptions applied

- No capital appreciation assumed

- Asset value generated for charging of security must normally be greater than net development cost so that overall balance sheet capacity is enhanced

- IRR must achieve a hurdle rate set on basis of: long term cost of funds + margin + interest cover buffer + risk buffer